Cash is a liquid asset, meaning that i can be spent on goods and services any time. Many business experience cash flow problems, meaning that they do not have enough cash to do what they want to do. Cash flow means "the flow of money in and out of a business". These are ways cash flow can occur:

Cash inflows:

- Sale of goods for cash.

- Payment from debtors.

- Borrowing from a source (but will inevitably lead to cash outflow in the future).

- Sale of unwanted assets.

- Investment from investors: shareholders and owners

Cash outflows:

- Purchasing goods for cash.

- Payment of wages, salaries and others in cash.

- Purchasing fixed assets.

- Repaying loans.

- Repaying creditors.

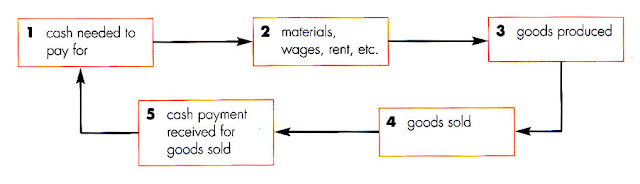

A cash flow cycle explains the stages that are involved in the process of cash out and finally into the business. This is what happens:

The longer it takes for cash to get back to the business, the more they will need working capital to pay off their short-term debts. This cycle also helps us understand the importance of cash flow planning. This is what happens when a company is short on cash:

- Not enough to pay for materials, therefore sales will fall.

- The company will want to insist customers on paying in cash, but they might lose them to competitors who let them pay in credit.

- There could be a liquidity crisis when it does not have enough cash to pay for overheads (bills, rent, etc.) and the business might be forced to close down by its creditors.

Managers need to plan their cash flow so that they do not end up in these positions.

Cash flow is not profit!

First we need to examine the formula for cash flow:

Cash flow = Cash inflow - Cash outflow

However, when calculating profit, we also take into account credit that debtors owe us. Therefore, a company might make $20,000 in profit but only $10,000 is received in cash because half of it is payed by credit card.

This creates something known as insolvency:

- Profitable business could run out of cash because of various reasons. This is called insolvency and it is one main reason why businesses fail.

- This can be because of several reasons:

- Allowing customers too long to pay back, so that they will not have paid off the debts yet by the time the business has run out of cash.

- Purchasing too many assets at once.

- Producing or purchasing too much stock/inventory when expanding too quickly. This is called overtrading.

As you can see, the closing bank balance in February is negative, which means that it has become overdrawn.

Cash flow forecasts

Because of the aforementioned problems, it is important for the manager to get an idea of how much cash will be available for which months. A cash flow forecast can tell the manager:

- How much cash is available for paying bills, loans and other fixed assets.

- How much the bank might need to lend to avoid insolvency.

- Whether the business has too much cash which could be more useful if used.

Uses of cash flow forecasts:

- Starting up a business: In the first months of a business, a lot of capital will be needed to set it up properly. The problem is, not everybody realises that the amount of money they needed is much more than they had expected. Therefore, a cash flow forecast will give them a better idea of how much money will be needed.

- Keeping the bank manager informed: It needs to be shown to the bank to inform it of the size of the needed loan/overdraft, when it is needed, how long it is needed and when it could be repaid. Only then will the bank give you a chance to get a loan.

- Running an existing business: It is important to know the cash flow of a business so that loans could be arranged in advance in order to get the least interest possible. If a firm has cash flow problems and goes to the bank for a loan for the next day, it will charge high interests because it knows that the business has no choice. Also, if a business exceeds the overdraft limit without informing the bank, it could be asked to repay the overdraft immediately and could result in closure of the business.

- Managing cash flow: If a business has too much cash, it should put the cash to some good use quickly. Some examples of this is: repaying all loans for less interest, paying creditors immediately to get discounts.

How can cash flow problems be solved?

Here are some steps to solve cash flow problems:

- Arrange for future loans with the bank when you anticipate negative cash flow.

- Reduce or delay planned expenses until cash is available, e.g. ask to pay in credit.

- Increasing forecasted cash inflow, e.g. by getting a part-time job.

For more information on the importance of cash flow visit page 132 in the book. This case study will give you a lot of information. As for the time being, thats the end of chapter 8!

================================================================

thank you wallah

ReplyDeleteTHANK YOU WALLA

ReplyDeleteTHANK YOUUUU WALLLAAAH! :'D I LOVE YOU! ps. unicorns rule <3

ReplyDeletethats quit interesting nd very helpfull 4 us bussiness gurus .thank u

ReplyDeleteI love your notes.... You rock!!!

ReplyDeleteThank you sooo much! You have absolutely no idea how helpful this was :) Do you make notes for other subject as well by any chance?

ReplyDeleteWell, Thanks a tonn again :)

i wish there is economics notes like this

ReplyDeleteThnx dawg

ReplyDeleteTo be honest, I've searched MANY times through the net to get a great summary like this but I've found none... This summary is AMAZING, I really appreciate the effort you've put into writing this!

ReplyDeleteThanks a ton!

ReplyDeleteI have the textbook you use for these notes! So thank you for the revision for it, as it is exactly what I need!Right down to the the same diagrams as the book

ReplyDeleteThank you

Book: IGCSE Business Studies (third edition) By Karen Borrington and Peter stimpson

yeah it is so similar

DeleteYeah got the same book too, but lost it and this is as good!

DeleteDammit you are just a fuckin amazin guy

ReplyDeletethanks a million

Awesomeeeee Love you muax! xx

ReplyDeleteThanks

ReplyDeletehayattee enta, thanks honey boo

ReplyDeletethnx a tonne srsly it saved my life frm the test

ReplyDeleteMeaning that it can be spend, not i

ReplyDeleteMay god bless you and your family dude!!!!

ReplyDeletebruv, keep doing what you're doing. This stuffs amazing!

ReplyDeleteYou are the best im using this to study for exams

ReplyDeletethanx a span hy!!!

ReplyDeleteThanks,this helped my revision

ReplyDeletethanks man ;)

ReplyDeleteu forgot to explain the cash flow cycle (meaning each stage ) but thanks a lot,ur site really helps me and a lot of people :)

ReplyDeleteThanks dude this site helps lot in making presentations ;)

ReplyDeleteMay be you could improve by saying some reasons how you can improve the cash flow problem.

ReplyDeletehowever your notes are just too good!!!

are you God

ReplyDeletewallah hbb thank u i fkn love u man

ReplyDeleteHOLA AAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAACHUPAMELAPIJAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAALIBRODEMIERDAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAMATERIADEMIERDAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAA

ReplyDeletegreat summery....thank you dude..... keep up the good work:

ReplyDeletea big thank you

ReplyDeleteyou are a legend

ReplyDeletethank you man

thank you :)

ReplyDeletethank you :)

ReplyDelete